Embarking on the journey to homeownership can be both exhilarating and daunting, especially for first-time buyers. The first home loan process is a crucial step that requires careful navigation. It begins with understanding your financial capabilities and the various loan options available.

The first step is to gather all necessary documentation, including proof of income, savings, and any existing debts. This information will help you determine how much you can afford to borrow and what your monthly repayments will look like. Once you have a clear picture of your finances, the next phase involves researching different lenders and their offerings.

Each lender has unique products, interest rates, and terms, which can significantly impact your overall borrowing experience. It’s essential to familiarize yourself with the types of loans available, such as fixed-rate, variable-rate, or interest-only loans. By understanding these options, you can make informed decisions that align with your financial goals and lifestyle.

Key Takeaways

- Understanding the First Home Loan Process:

- Familiarize yourself with the steps involved in obtaining a first home loan to better prepare for the process.

- Researching and Comparing Lenders:

- Take the time to research and compare different lenders to find the best fit for your financial needs and goals.

- Assessing Your Financial Situation:

- Evaluate your current financial situation to determine how much you can afford to borrow and repay for your first home.

- Exploring Government Grants and Incentives:

- Look into available government grants and incentives for first home buyers to maximize your purchasing power.

- Choosing the Right Loan Type:

- Consider different loan types and their features to select the most suitable option for your first home purchase.

Researching and Comparing Lenders

When it comes to securing a mortgage, not all lenders are created equal. Researching and comparing lenders is a vital step in the home loan process that can save you thousands of dollars over the life of your loan.

Start by looking at major banks, credit unions, and non-bank lenders to get a comprehensive view of the market.

Each lender will have different criteria for approval, interest rates, and fees, so it’s essential to gather as much information as possible. Utilizing online comparison tools can streamline this process, allowing you to see side-by-side comparisons of various loan products. Pay close attention to the annual percentage rate (APR), which includes both the interest rate and any associated fees.

Additionally, consider customer reviews and ratings to gauge the lender’s reputation for service and support. A lender with a strong track record of customer satisfaction can make your borrowing experience much smoother.

Assessing Your Financial Situation

Before diving into the mortgage application process, it’s crucial to assess your financial situation thoroughly. This involves taking a close look at your income, expenses, savings, and existing debts. Understanding your financial health will help you determine how much you can afford to borrow without stretching your budget too thin.

A good rule of thumb is to aim for a mortgage payment that does not exceed 30% of your gross monthly income. Additionally, consider your long-term financial goals. Are you planning to start a family soon?

Do you anticipate changes in your job or income? These factors can influence how much you should borrow and what type of loan is best suited for your needs. By taking the time to evaluate your financial situation comprehensively, you can make informed decisions that will benefit you in the long run.

Exploring Government Grants and Incentives

| Government Grants and Incentives | Benefits | Eligibility |

|---|---|---|

| Funding for Research and Development | Financial support for innovative projects | Companies engaged in R&D activities |

| Small Business Grants | Assistance for small business growth | Small and medium-sized enterprises |

| Energy Efficiency Incentives | Financial rewards for energy-saving initiatives | Businesses implementing energy-efficient practices |

As a first home buyer in Australia, you may be eligible for various government grants and incentives designed to make homeownership more accessible. Programs such as the First Home Owner Grant (FHOG) provide financial assistance to eligible buyers, helping to offset some of the costs associated with purchasing a home. Each state has its own criteria for eligibility, so it’s essential to research what’s available in your area.

In addition to grants, there are also schemes like the First Home Loan Deposit Scheme (FHLDS), which allows eligible buyers to purchase a home with a deposit as low as 5%. This initiative can significantly reduce the financial burden on first-time buyers who may struggle to save for a larger deposit. By exploring these options, you can take advantage of government support that can make your dream of homeownership a reality.

Choosing the Right Loan Type

Selecting the right loan type is one of the most critical decisions you’ll make as a first home buyer. There are several options available, each with its own advantages and disadvantages. Fixed-rate loans offer stability with consistent monthly payments over a set period, making budgeting easier.

On the other hand, variable-rate loans can fluctuate with market conditions, potentially offering lower initial rates but with the risk of increases in repayments. Another option is an interest-only loan, which allows you to pay only the interest for a specified period before transitioning to principal repayments. This type of loan can be beneficial for investors or those looking to keep initial costs low.

Ultimately, the right loan type will depend on your financial situation, risk tolerance, and long-term goals. Consulting with a mortgage broker can provide valuable insights into which loan type aligns best with your needs.

Understanding Interest Rates and Fees

Interest rates play a significant role in determining the overall cost of your mortgage. A lower interest rate can save you thousands over the life of your loan, making it essential to shop around for the best deal. Keep in mind that interest rates can vary based on factors such as your credit score, loan amount, and deposit size.

It’s crucial to understand how these factors influence the rates offered by different lenders. In addition to interest rates, be aware of any associated fees that may come with your mortgage. These can include application fees, valuation fees, and ongoing account-keeping fees.

Some lenders may offer no-fee loans but compensate with higher interest rates. Therefore, it’s essential to look at the total cost of borrowing rather than just focusing on the interest rate alone. A comprehensive understanding of both interest rates and fees will empower you to make informed decisions that align with your financial goals.

Preparing for the Application Process

Once you’ve done your research and selected a lender, it’s time to prepare for the application process. This stage requires gathering all necessary documentation to support your application. Common documents include proof of income (such as payslips or tax returns), bank statements, identification documents, and details about any existing debts or liabilities.

Being organized and thorough in this stage can expedite the approval process significantly. Lenders will assess your application based on various factors such as your credit history, income stability, and overall financial health. The more prepared you are with accurate documentation, the smoother the process will be.

Additionally, consider seeking assistance from a mortgage broker who can guide you through this stage and help ensure that all necessary paperwork is submitted correctly.

Tips for Saving for a Deposit

Saving for a deposit is often one of the most challenging aspects of buying your first home. However, with careful planning and discipline, it is achievable. Start by setting a clear savings goal based on the type of property you wish to purchase and the deposit required by your chosen lender.

A common target is 20% of the property’s value; however, many lenders offer options for lower deposits. To boost your savings efforts, consider creating a dedicated savings account specifically for your deposit fund. This separation can help you track progress more effectively and resist the temptation to dip into those funds for other expenses.

Additionally, explore ways to cut back on discretionary spending or increase your income through side jobs or freelance work. Every little bit helps when it comes to reaching your deposit goal.

Working with a Mortgage Broker

Navigating the mortgage landscape can be overwhelming for first-time buyers; this is where working with a mortgage broker like Champion Broker becomes invaluable. With 19 years of experience in the industry and having assisted over 960 clients in achieving their Australian dreams, Mahi Masud is an award-winning mortgage broker who understands the intricacies of securing favorable mortgage deals. A mortgage broker acts as an intermediary between you and potential lenders, helping you find the best loan options tailored to your specific needs.

They have access to a wide range of lenders and products that may not be available directly to consumers. By leveraging their expertise and industry connections, brokers can negotiate better terms on your behalf and guide you through every step of the process.

Understanding the Importance of Credit Scores

Your credit score is one of the most critical factors lenders consider when assessing your mortgage application. A higher credit score indicates responsible borrowing behavior and increases your chances of securing favorable loan terms. Conversely, a lower score may result in higher interest rates or even denial of your application altogether.

To improve or maintain a healthy credit score, it’s essential to pay bills on time, keep credit card balances low, and avoid taking on new debt before applying for a mortgage. Regularly checking your credit report for errors or discrepancies is also advisable; correcting any inaccuracies can positively impact your score. By understanding how credit scores work and taking proactive steps to improve yours, you’ll be better positioned when applying for a home loan.

Avoiding Common First Home Buyer Mistakes

As a first-time home buyer, it’s easy to fall into common pitfalls that can hinder your journey toward homeownership. One prevalent mistake is underestimating additional costs associated with buying a home beyond just the purchase price—such as stamp duty, legal fees, and ongoing maintenance costs. It’s crucial to budget for these expenses to avoid financial strain down the line.

Another common error is failing to conduct thorough research on neighborhoods or properties before making an offer.

Take the time to visit potential homes multiple times at different times of day and research local amenities and schools.

Additionally, don’t rush into decisions; take time to weigh all options carefully before committing to a purchase.

By being aware of these common mistakes and taking proactive steps to avoid them, you’ll be better equipped for a successful home-buying experience. In conclusion, navigating the first home loan process requires careful planning and informed decision-making at every stage—from understanding loan types and interest rates to working with experienced professionals like Champion Broker. With Mahi Masud’s extensive expertise guiding you through this journey, achieving your dream of homeownership in Perth becomes not just possible but attainable.

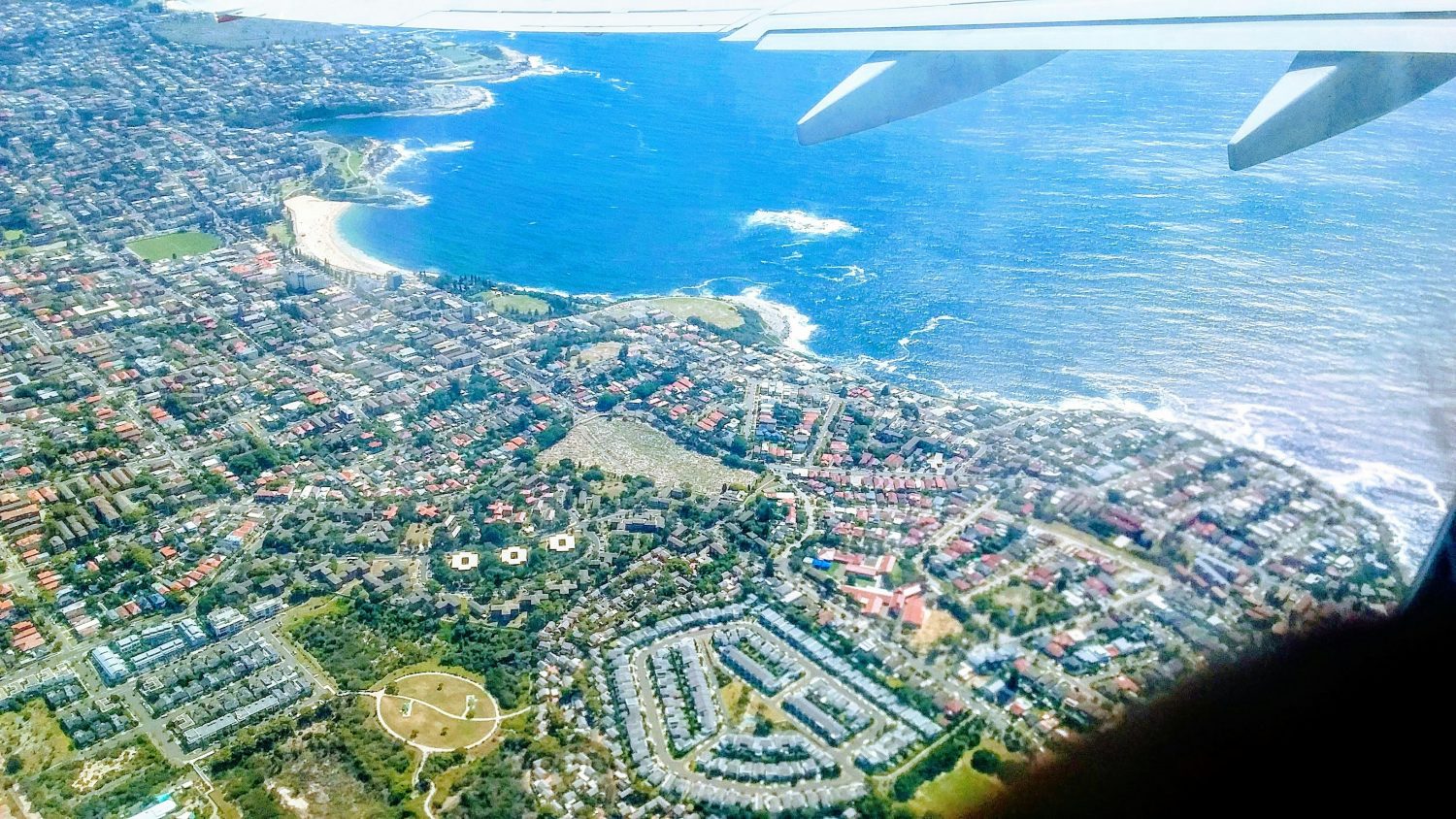

If you are considering buying your first home in Perth, you may want to explore the median house prices in different suburbs to make an informed decision. A recent article on median house prices in Armadale provides valuable insights into the real estate market in that area. Understanding the market trends and prices can help you determine the best first home loan options available to you.